What does a late payment do to your credit score?

How do you know the effect of a single late payment on FICO score?

A FICO score is a number predicting future credit performance based on credit history. Like any person's past, it's difficult to say precisely what was the effect of a past event on the present.

Past credit events and current FICO scores are the same way.

We've analyzed tens of thousands of credit files, hundreds of thousands of negative events, databased before-and-afters… We know how negative events affect FICO mortgage scores – and how many points they cost the borrower.

This is what we do. But, it gets complicated.

It is extremely rare to see the effect of a single negative event by itself, shown this clearly, in the FICO score. That's what makes this recent credit file special.

This file that isolates and reveals the cost of a recent 30-day late – all by itself – on the borrower's score. So obvious that anyone can see it.

A late payment only on one bureau's credit file

This borrower had an inaccurate 30 day late payment on his credit report. The creditor notified the bureaus. Somehow, TransUnion didn't get the message. It remained in their file and not in the others.

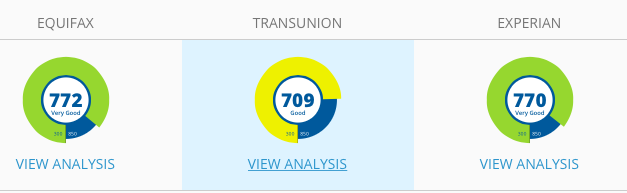

Here's the score result:

The TransUnion score was 61 points lower than Experian and 63 points lower than Equifax. The difference is due only to the late payment.

For most people, this 60+ point drop would be astounding. And far too many think that after they catch up, any harm goes away.

Wrong. They were late paying; it's still part of their credit history. Usually, this is the most surprising thing for borrowers when we teach it during our education phase.

Now imagine this happening after approval and before closing.

That's why we constantly remind borrowers to be perfect with payments during the buying process and recommend mortgage professionals do the same whenever they can.

FICO mortgage scores are different than other credit scores in this situation

FICO score models used for credit cards and auto loans are very different. Bankcard and auto scores are based on FICO 8 model and are much more forgiving of single late payments – and lower amount negative items.

This is one reason your free FICO scores from your credit card provider, or free scores from a website, can be much higher and misleading when you apply for a mortgage. (See Free Credit Score Can Confuse Home Buyers )

Two other factors affecting late payments and FICO scores

This late payment occured eight months ago. By FICO standards this is considered "recent." Its effect on the score is very high; but will fade over time (See Time Heals; Recency Kills.)

We also need to bear in mind another rule: the higher the start, the greater the fall. With a lower score, this event would have less impact. (See Credit mistakes and credit scores: the higher you start, the farther you fall.)