Providing a useful service makes a good job; helping people achieve their dreams makes a good life.

Our sincere thanks to all those who have shared their dreams with us.

“I have one of the best jobs in the world – making dreams come true for folks!”

CSG Analyst Mike Garcia

Get your Monthly FICO® 3-bureau credit report at this link. Be sure to click on the Monthly and not the Quarterly product.

First things first:

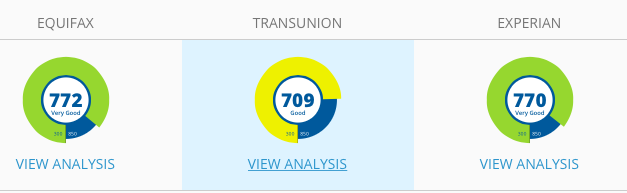

- The first score you see is not your Mortgage score. The first scores you see on your Dashboard are FICO 08 scores. FICO 08 scoring models are NOT used in mortgage lending. Ignore them.

- While you are using this monitoring service you will get frequent alerts on “Score Changes”. These alerts are, again, for changes to the FICO 08 Scoring models, not the mortgage models, so just ignore them also.

This often confuses people – we get calls all the time: “My score is different!” and “I got a new alert!” This is all irrelevant to your mortgage credit report and scores.

At myFICO™ you will pay for three-bureau monitoring and, most importantly, you will get your mortgage FICO® Scores each month as a part of your subscription. No inquiries will be put on your credit report.

There is no other way for consumers to get FICO® mortgage scores outside a hard inquiry from a lender. And a hard inquiry can lower your score.

When you get the reports/scores, you will get 10 FICO scores for each bureau. The first scores you see on the site, on the Dashboard, are FICO 08 scores. FICO 08 scoring models are NOT used in mortgage lending.

To See Your Mortgage Scores

Go to the tab “Scores” and click on each bureau. Then scroll down to see the second score in the list. These are the mortgage scores. You will see the note: “Commonly Used in Mortgage Lending.”

These scores are called FICO 2 for Experian, FICO 5 for Equifax and FICO 4 for TransUnion.

Related Article

If you're interested in learning more about all the various credit scores and what matters in mortgage loans see our article: Free Credit Scores Can Confuse Homebuyers.

Tim Arrowood of Peoples Home Equity had a great idea for his referrers during the lockdown: a Real Estate Quarantine School.

He invited Eddie to talk about credit today and was kind enough to let us post the talk here.

Our Senior Credit Analyst Mike Garcia has been advising Tim's referrals for many years.

Tim is Branch Manager for Peoples Home Equity in Kingsport, TN. [423-406‑1567; ArrowoodTeam.com]

Most people don’t know how the system works, and that's often why scores go down when difficult decisions are made in difficult times.

Credit advice for difficult times

For the last 16 years, we’ve advised lenders and borrowers on credit scores and how the system works – to help people increase their credit scores to get the best mortgage possible.

Now, we hope to use our knowledge to help those facing financial stress to help them weather this crisis and protect their family’s financial future.

If this applies to you, we know money is very tight, but with the same amount of money, you can make decisions that hurt your credit score or ones that keep your score.

Paying all your bills on time is always the best for your credit, but this may not be possible during this crisis.

This guide is to help you keep from lowering your credit score if at all possible.

However, it may be unavoidable for some. At the least, we want to help you make the right choices to give you the ability to rebuild your credit quickly after this is over.

Having the right information is necessary to make good choices - particularly under stress.

Who this guide is not for: If you are planning or in the process of major credit purchase, like a new home mortgage or refinance, check with your lender or us first.

1 / Gather Information

Get all the information you need and keep it together in one place.

2 / Learn How the System Works

Understand how different events affect your score and what’s most important.

3 / Prioritize and Negotiate

Use this knowledge to prioritize payment and negotiate with creditors.

1) Gather Information

You need a recent copy of your credit report (see sidebar) to know which accounts are on it. In general these are:

- Current loan accounts for mortgage, vehicles and student loans.

- Revolving accounts like credit cards and store accounts.

- Accounts that go into collection.

Utilities and phone/internet are usually not on your credit report.

Bank statement(s)

Know what your other recurring bills are. (Look for any that you can cancel or pause for now to save money better used elsewhere.)

Notices from creditors

Many creditors are sending out notices related to this crisis. Many are offering deferred payments, payment plans and other arrangements.

All other bills

If you aren’t already, now is a good time to keep all bills and statements in one place and keep track of where you are in payments.

How to get your credit report

To know what determines your credit score you need your credit report. Federal law requires Equifax, Experian and TransUnion to give you a free credit report every 12 months.

The easiest way to get these is from AnnualCreditReport.com. You’ll get your credit file from each bureau, so you can also check each bureau’s file for accuracy. You’ll see which bureaus are – and are not – using which credit accounts to calculate your credit scores.

The easiest way to get these is from AnnualCreditReport.com. You’ll get your credit file from each bureau, so you can also check each bureau’s file for accuracy. You’ll see which bureaus are – and are not – using which credit accounts to calculate your credit scores.

There is no credit score provided; but, it’s free and will tell you which accounts are affecting your credit score.

If you get a free report from another source, it will do, but know it’s only from one bureau

2) Know How the System Works

Accounts on your report determine your score

Creditors and accounts on your credit report are affecting your score. Those not on your credit report are not affecting your credit score.

Revolving accounts matter most

Credit cards and store cards help and hurt your score the most.

Credit cards and store cards help and hurt your score the most.

You have positive and negative accounts

Accounts that are paid as agreed, no late payments, increase your score. The longer with no negatives, the more they help.

Negative accounts such as collections and those with late payments hurt your score.

Dollar amounts don’t matter

If you are late on a $10 monthly payment, it hurts your score as much as being late on a $1000 monthly payment. This applies to credit cards, but in another and different way also:

How credit card balances are scored

Again it’s not the dollar amount, but the ratio of balance to limit. For example: $500 balance with $1,000 limit = 50% = $5,000 balance/$10,000 limit.

Severity/Time matters

For your score, being late 90 days is much worse than being late 60 days, which is much worse than being 30 days late. This becomes important when we look at what to do if you have to be late in the next section.

Credit inquiries lower your score

When you apply for new credit, your score is lowered temporarily. Inquiries are listed on your credit report.

3) Use this Knowledge to Protect Your Credit

Negotiate with creditors

Take advantage of all special offers of deferments from creditors. Negotiate with your landlord, mortgage holder and other creditors to lower or defer payments. Avoid late payments and collections if at all possible. Take action first.

Apply for credit card limit increases

Since it is the ratio of balance to limit that determines your score, increasing your limit has the same effect as lowering your balance.

If you bank online, you probably can easily request this on their website. Try it with the cards you have the highest balance and highest ratio first. You may be declined, especially if you have bad history or a very high balance with the card issuer, but it’s worth a try.

Pay special attention to credit cards and balance your balances

Since these accounts affect your score the most, try to keep them current, and spread your credit purchases out according to their limits, trying to keep the ratio low across them all. It should go without saying, if money’s tight pay the minimums for now.

Do not close credit cards

Some think closing cards will improve their credit. Remember you have positive credit also. If you cancel a card, you’re removing open credit that will help you more each month as it ages. And if you close it with a balance, you’ll have to pay it all anyway.

Focus on accounts on your credit report

Prioritize your outlays to those accounts that are on your report.

Bear in mind even a non-reporting account will likely hit your credit report if it goes into collection.

If you must be late, remember the rules of the severity and time

Late payments - payments over 30 days past the due date - hurt your score and stay on your report for seven years. Even if you catch up soon, it doesn't change the fact that you paid late. Anything other than 'paid as agreed' on accounts on your credit report hurts your score. That’s why you want to avoid late payments to creditors on your credit report.

But if you cannot avoid it, you can limit the damage by remembering: Dollar amounts don’t matter. It is the number of late payments and their severity: 90 days versus 60 days versus 30 days late. Here’s how you apply this knowledge:

Say you have four monthly payments: $800, $120, $100 and $75 and you only have $850 to use. If you pay the $800 and not the rest, you incur three late payments on your report.

Your credit will be much better if you pay the other three and have only one late. Better still, pay those three and negotiate a deferred payment with the other. Most auto loans will agree to this.

The severity rule also applies when you have to make a choice between incurring a new 60 day late on an account or a new 30 day late on a different account. One 60 day late is worse than two 30 day lates. And one 90 day late is worse that two 60 day lates.

We hope you don’t have to make these choices, but if you do, balance your late payments with this severity rule in mind.

Dealing with Collections

Collections can be as damaging as a 90 day late or worse. Keep your eyes out for a collection notice particularly for accounts you are late on. If you get a collection notice, contact the creditor, and – if you're able – try to pay it with the agreement that it won’t be reported. If you act quickly this should stop it.

Or, if you can't pay the bill, negotiate a payment plan with their agreement that if you make payments as agreed, they will not report a collection to the bureaus. You don’t want to pay and hurt your credit both. If you act soon enough, you can very often avoid the collection hitting your report.

Doing nothing or ignoring the collection notice is the worst reaction. Be aware, communicate, offer to work something out. Bill collectors rarely refuse honest effort.

There is a lot of news and information on the health aspects of the virus. Your attitude and actions will depend on many factors including where you live, your age, occupation and your view of the risks. There are government guidelines and restrictions that vary by location.

We’d like to bring some attention to another segment of Americans being affected negatively, and offer suggestions that we think will fit with whatever personal decisions you make.

This involves the jobs and livelihood of our friends, families and communities.

Travel and Hospitality Workers

In addition to the health dangers, there are others having trouble during this time, particularly those in the travel and hospitality industry. Many are in danger of losing their jobs and do not have the savings necessary to weather this.

How you can help:

Book and pay for your future events now: hotel accommodations, travel/transportation providers, event coordinators, etc. This slowdown will not last forever; you can save money and help people keep their jobs.

Support your local restaurants and stores. Buy gift certificates, order home delivery, takeout or drive through. Patronize during the slow times. And be sure to leave an extra large tip for those who depend upon them.

Entertainment and Sporting Event Staff

Support staff for these are huge, and we can’t forget that they’re going through a very tough time.

How you can help:

Many of these events are scheduled far in advance. Buy your tickets now, you have nothing to lose if the event is cancelled later. Help keep money flowing through this industry now.

Ripple Effects on Other Industries

Our economy is interwoven and there will be effects rippling through many other areas.

How you can help:

As much as possible within healthy guidelines, continue your normal activities, your patronage and economic activity. Within your capabilities, be creative and think of others who rely on you for their livelihood. Help them stay in business and keep going during the coming months.

The Elderly and Infirm

With their increased risk, many elderly and infirm are in quarantine – whether it’s self-quarantine or an imposed restriction on visitation to nursing homes and assisted living facilities. Being separated from loved ones is hard.

How you can help:

Find a way to video-visit your loved ones that you can’t see in person. Use Facetime, Skype or one of the free video conferencing apps. If necessary, get a computer for your loved one. If you can, donate inexpensive, capable devices to nursing homes that need them and can share them with their clients.

See if the elderly or infirm that you know need help with supplies, food and staples. Volunteer to deliver to them – leaving it at their door and being sure to exercise self hygiene prior. Be proactive, many won’t tell you or complain unless you ask - firmly.

Give an extra 'thank you' to those keeping us going

Doctors & nurses, pharmacists, pharmacy techs, other healthcare workers and hospital support staff; grocery store employees, truck drivers, police and fire, EMS, postal workers and delivery people…

Please send us your ideas and suggestions so we can add them to this list.

For the latest government information and guidelines, go to the CDC Website:

Different lenders use different score models for different lending decisions.

FICO's newly announced FICO® Score 10 Suite is getting a lot of attention and news coverage. Let's cut to the chase:

What does this new score model mean to you now?

Short term answer for all borrowers: “Nothing.”

Medium term answer for all borrowers: “Maybe, in a few years, depends on what you're using credit for, we’ll talk…”

Short to medium term answer for home buyers and mortgage lenders: “Nothing.”

What? Why?

Historically, lenders have been slow to adopt new models from FICO®. If the lender doesn’t use it, it means nothing to the borrower.

The new FICO® model version is number 10, the most popular version in use is 8 (from 2008) and for mortgage lending Versions 2, 3 and 5 (1998-2004) are used (because they are mandated by Fannie Mae and Freddie Mac).

For home loans, when you see headlines like: "Fannie Mae to Adopt New Credit Score Model," that's the time to pay attention.

What's my credit score confusion

Different FICO score models are used by different lenders for different purposes (auto, credit card, mortgage). Adding more confusion are the score models developed and promoted by the credit bureaus; these are almost always higher than the lender’s score and cause the most disappointment when borrowers get their mortgage score from a loan officer. See: “Free Credit Score Can Confuse Homebuyers.”

Credit Security Group Helps Mortgage Professionals

We are 100% referral based and have been since we began in 2004. Our goal is to help your borrowers increase their credit score to qualify for the best mortgage loan possible.

If you are a mortgage professional and want to know more about our service and how to refer, please go to this page: "For Mortgage Professionals."

A year ago we registered Credit Security Group as a business on Google. This month we passed the 100 mark in 5-star reviews from our clients.

We are very grateful for our clients and appreciate that so many have taken the time to tell about their experience on Google reviews.

And, we're very grateful to our mortgage professional partners who refer these folks to us so we can be of help.

From our analysts Eddie, Mike, Lance, Rosalind, from our Research staff , Diana, Angel and Mary and from everyone at CSG: Thank you!

You can read CSG Google Reviews here; and our Client Testimonials here…

How do you know the effect of a single late payment on FICO score?

A FICO score is a number predicting future credit performance based on credit history. Like any person's past, it's difficult to say precisely what was the effect of a past event on the present.

Past credit events and current FICO scores are the same way.

We've analyzed tens of thousands of credit files, hundreds of thousands of negative events, databased before-and-afters… We know how negative events affect FICO mortgage scores – and how many points they cost the borrower.

This is what we do. But, it gets complicated.

It is extremely rare to see the effect of a single negative event by itself, shown this clearly, in the FICO score. That's what makes this recent credit file special.

This file that isolates and reveals the cost of a recent 30-day late – all by itself – on the borrower's score. So obvious that anyone can see it.

A late payment only on one bureau's credit file

This borrower had an inaccurate 30 day late payment on his credit report. The creditor notified the bureaus. Somehow, TransUnion didn't get the message. It remained in their file and not in the others.

Here's the score result:

The TransUnion score was 61 points lower than Experian and 63 points lower than Equifax. The difference is due only to the late payment.

For most people, this 60+ point drop would be astounding. And far too many think that after they catch up, any harm goes away.

Wrong. They were late paying; it's still part of their credit history. Usually, this is the most surprising thing for borrowers when we teach it during our education phase.

Now imagine this happening after approval and before closing.

That's why we constantly remind borrowers to be perfect with payments during the buying process and recommend mortgage professionals do the same whenever they can.

FICO mortgage scores are different than other credit scores in this situation

FICO score models used for credit cards and auto loans are very different. Bankcard and auto scores are based on FICO 8 model and are much more forgiving of single late payments – and lower amount negative items.

This is one reason your free FICO scores from your credit card provider, or free scores from a website, can be much higher and misleading when you apply for a mortgage. (See Free Credit Score Can Confuse Home Buyers )

Two other factors affecting late payments and FICO scores

This late payment occured eight months ago. By FICO standards this is considered "recent." Its effect on the score is very high; but will fade over time (See Time Heals; Recency Kills.)

We also need to bear in mind another rule: the higher the start, the greater the fall. With a lower score, this event would have less impact. (See Credit mistakes and credit scores: the higher you start, the farther you fall.)

New standards on public records reporting

One thing is for certain: many public records that used to be found on credit reports are no longer there.

Lenders are still responsible for knowing this information, and other service providers are filling the gaps to provide it, usually at additional expense to the lender. But what is the effect – now – on credit scores?

In February of 2018, the Consumer Finance Protection Bureau (CFPB) released a report of their findings on the impact of the new requirements on credit scores.

John Culhane Jr. of Consumer Finance Monitor analyzed these results in his article: "CFPB report finds removal of public record data has small effect on credit scores." The title tells you his summary of the CFPB analysis.

How many public records were removed from credit reports due to the new requirements?

The first key point is the scope of public records removed from credit files at the major bureaus:

In June 2017, soon before the new standards were implemented, 6 percent of consumers had a civil judgment or tax lien. As a result of the new standards, about 83 percent of these consumers lost one or more judgments or liens in July 2017. After the new standards were implemented, only 1.4 percent of consumers had a tax lien on their credit reports.

That's a huge percentage of those who had public records who no longer have them in their credit file at the bureaus – gone from their report, scoring model and FICO mortgage score.

What is the result on credit scores?

The second point is the most surprising:

About 4 percent of consumers with civil judgments or tax liens on their credit reports in June 2017 experienced an increase in their credit scores in September 2017 due to the new standards.

Only four percent.

How can removing judgments and liens have such a small effect on credit scores?

The CFPB has one possible explanation for this:

The CFPB seems to suggest that the small effect might have been expected because consumers who had civil judgments and tax liens also had more delinquencies and more derogatory information in their credit reports.

Culhane posits a different take on the report:

The new report’s findings might be seen as subtle criticism by the CFPB under Mick Mulvaney of the Plan and former Director Cordray’s CFPB. In other words, the report’s findings could be seen to show that the concerns about the reporting of civil judgments and tax liens that drove the [National Consumer Assistance] Plan were largely overblown.

We're left in a 'who do you trust' position, statistically speaking. You can read Culhane's article here, and see the CFPB full report here.

Will public records reappear on credit reports in the future?

The changes to the standards were part of the National Consumer Assistance Plan:.

The NCAP was the result of settlement agreements between the NCRCs [Nationwide Credit Reporting Companies - Equifax, Experian, TransUnion] and over 30 State Attorneys General… Starting July 1, 2017, public record data furnished to the NCRCs for inclusion on credit reports had to contain name, address, and Social Security Number and/or date of birth, and had to be refreshed at least every 90 days.

Theoretically, this could be fixed going forward. Whether these requirements are met and these public records make it back into credit reports remains to be seen.

We've helped mortgage professionals close over a billion dollars in home loans. If you're a mortgage loan officer or broker, please visit our page For Mortgage Professionals to learn how and why to refer your borrowers. Or contact us to discuss how we can help you.

If you are selling your home and there is a judgement lien, does this have to be paid first?

Not in Texas according to Attorney T. Alan Ceshker.

Recently, we had a client who was refinancing his house and an old judgment popped up. The lender said he had to pay it; he came to us hoping we could delete it. We remembered the Texas law on this and reached out to Alan for help.

Ceshker is a practicing attorney with a title office that routinely runs into these situations. He has been successful in getting the lien partially released from the homestead in every instance – several hundred times in the last 20 years.

According to Ceshker:

A judgment recorded in the real property records is a lien on all real property of the defendant. But the Texas Constitution and the Texas Property Code specifically excludes this lien from attaching to a person’s homestead.

Despite this clear statement of law, a title office will still require a partial release of lien (i.e. releasing the homestead property to be sold or refinanced).

If the judgment creditor will not release the lien for the specific homestead property, there is existing caselaw that will allow damages to be recovered if the judgment creditor does not release the lien (Tarrant Bank vs. Miller 813 SW 2d 666 (Tex. App. – Eastland 1992, writ denied).

A conventional title office (non-attorney owned) will not be able to act on behalf of the judgment debtor to get this removed.

You can reach Ceshker via his website, The Law Offices of T. Alan Ceshker, PC, or by calling 512-961-7848.

“Build credit” is the advice given by loan officers and banks every day, hundreds of thousands of times a day. We wonder how many of those people are being hurt from advice to "build credit."

“Build credit” is the advice given by loan officers and banks every day, hundreds of thousands of times a day. We wonder how many of those people are being hurt from advice to "build credit."

In this post we want to warn of the danger of giving this advice to the wrong borrowers and illustrate how it can damage loan opportunities.

A recent case example

A past client came to us to help increase his score to do a cash-out refinance for some home improvements. (We'd help him purchase the home in 2017.)

His mid-score now is 694. According to his loan officer:

His debt-to-income ratio, loaned value in the house, and a 680-plus credit score would normally result in automated approval at Fannie and Freddie. But the loan officer can't get automated approval. Automated underwriting findings were flagging a lot of recent accounts and inquiries.

He had opened eight accounts in the past 12 months which really hurt his loan opportunities. Why did he open the new accounts?

He went to his credit union and mentioned that he really needed his scores higher. And they suggested that he to open up installment accounts; that he needed to build credit. Bad advice for him.

When is “build credit” good advice?

Building credit is what someone does when their credit report is blank; 18-year olds build credit. Building credit applies to people without any credit history.

Most older people have already built credit history that is being scored.

When else can opening new accounts help?

There are those who have credit history, but lack certain types of open accounts. Here, opening new accounts can help. But only the right types of accounts and only after a detailed analysis of their credit file and loan program.

This is critical to make sure new accounts will increase your borrower's score – not lower it.

Related Article:

We first applied for and were granted accreditation by the Better Business Bureau in May, 2009. We greatly appreciate the work they do in our industry by helping people find businesses they can trust.

We realize that when you refer your borrowers to us, both of our reputations are at stake. That's why everyone on our teams works to make sure that every borrower is helped and is treated with great respect and honesty.

The result is our BBB A+ rating, hundreds of client testimonials and 5-star Google reviews. We very grateful for these and most of all grateful for the trust you place in us when you refer.

After analyzing tens of thousands of credit reports, one conclusion is all too clear: any negative event will severely lower a FICO score. But how much?

Every credit file is unique. Any credit event, whether a new account, an inquiry or late payment or collection will be scored as it fits into the whole of the credit history. The only way to fully understand the events impact is to analyze the whole credit file, something only our analysts can do.

Given this caveat, we can make some general statements and give ball-park results.

The best way to understand how much a negative event will lower your score is to remember one key rule: the higher you start, the farther you fall.

For example, if an 800 FICO score gets one $10 medical collection, the score could drop close to a 100 points. This effect of this same collection on a 680 FICO score is roughly half: around 50 points.

Paying the collection does not get any points back in either case.

Some would think that a 30-day late is just a minor boo-boo. After all, maybe it was only on a little department store card with a monthly payment of $15.

In reality, scores can drop significantly – enough to dramatically change the terms of a mortgage or an auto loan. An 800 score could lose up to 70 points on that 30-day late. For a 680 credit score, the fall could be 50 points.

Always remember this, there are no boo-boos in the credit world, only bombs and bigger bombs. You must be flawless in paying bills on time; you must avoid anything derogatory.

Few things in our lives require absolute perfection every day, every month and every year. Credit is one of those things.

‘Let's dispute it and take it out of score.’

Loan officers miss this a lot and so do consumers.

Many believe – and try to use the tactic of – “Hey, let’s dispute this account online. Put it in dispute to take it out of the credit score.”

Things have changed since this tactic began over 12 years ago. The mortgage world responded and now it's just not that simple or effective. Unfortunately, this fallacy persists in the mortgage industry.

Disputes can also kill loans

Today, there is the additional problem of accounts with dispute wording killing a loan program:

"I have a lot of people hiring attorneys to dispute everything from kingdom come and back. And then they come to us and want to do a conventional loan, and it ain't happening.

I just spent about $700 of my company's money to remove a ton of disputes that somebody paid a couple thousand dollars to put in there in the first place that actually did nothing."

– Senior Loan Officer

Reinvestigation vs. in dispute

There’s an assumption that when you write a letter or dispute something online, which creates a 30-day investigation (called a reinvestigation under the Fair Credit Reporting Act), that you are putting the account “in dispute” and removing its effect on the credit score.

But reinvestigation and “in dispute” are two different things.

Disputing an account means that in 30 days an investigation will be completed, in 30 days or less. At the end of that investigation, the account can look exactly like it looked before or have some changes the investigation produced. But it's wrong to assume that because it was disputed, that the account will be “in dispute.”

This goes back to the Metro 2 code where there are very different types of disputes: disputed by consumer, dispute resolution pending, dispute after resolution. One of those may or may not be on the account when it’s over.

Don't assume that disputed equals out of score

And, that brings us to our main points:

- Not every disputed account will remain in dispute when the investigation is completed.

- Not every account that is in dispute when the investigation is completed is out of the scores.

Disputing accounts has a valid function when used correctly

Disputing information at the the credit bureaus and with creditors is sometimes warranted and of value to the borrower.

There is a valid use but always with the loan program in mind – and after a thorough analysis of the full credit file and the borrower's situation, goal and time frame.

Mortgage professionals should very wary of so-called credit repair companies that advise disputing all negative accounts.

Related article:

Increasing FHA loan limits is very good news for homebuyers getting squeezed by increasing home prices.

“The FHA loan limits for Texas were increased from 2017 to 2018. At least in most counties… The maximum mortgage amount for most of the state is $294,515, for a single-family home purchase. Higher limits are allowed in areas with higher home prices, like the Austin and Dallas metro areas.”